Past Market History Trends A Profitable History Lesson A Simple Demonstration of Market History Will Show You How You May |

How do you create greater financial certainty in an uncertain world? More importantly, how do you create greater confidence and predictability in retirement? You have to create the right foundation for your situation. In my opinion, that foundation should consist of security and a predictable, guaranteed* income stream, so that you are able to spend with more confidence in retirement. |

|

|

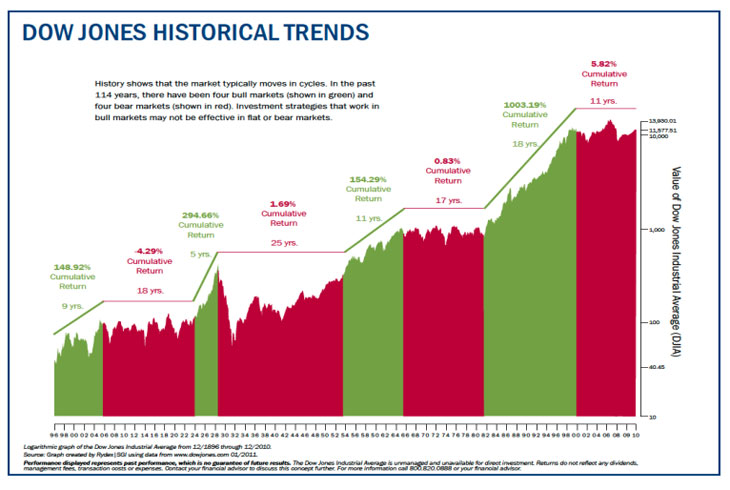

Since so many of us rely on the market, which is unpredictable (stocks, mutual funds, Variable Annuities, etc.), let’s take a look at what market history and what is happening in today’s market. For starters, the U.S. government has been downgraded, Greece is on the verge of default, and the S&P and Dow Jones have been an absolute roller coaster over the last 12 years. With all of these ups and downs and financial uncertainties, more people are working longer because they are very concerned about their long-term finances. They are looking at their finances daily. People shouldn’t have to do that in their retirement years. Most retirees want to be able to spend with confidence and have peace of mind when it comes to their finances. Retiring is a big deal and a big step in one’s life, and not being sure if you will be able to afford what you used to be able to afford during your working years may be a big concern. However, it is something that can be avoided. To learn how to avoid it, call us today at 954-781-2220 or fill out this short survey. One thing that might create more peace of mind in retirement is having a predictable income stream that will help you to maintain your lifestyle. Here’s A Look At How We Got To Where We Are Today FinanciallyAnd What I Believe Is Going To Happen Next. If you have your nest egg in the market, you probably believe that the market will go up. It is important to understand a little bit of market history because you want to see trends and you want to be able to have an idea of what could possibly happen over the next several years and how it may affect your retirement. So, let’s take a look. Back in 2000, just 12 years ago, the S&P 500® was at an index of 1500. Compare that to where it’s at today: the 1300 range. Let’s go even further back than that, and look at the Dow Jones. The Dow Jones was created in 1896. At that time it wasn’t the Dow 30; it was the Dow 12. What is interesting about the Dow 12 is that of those 12 companies, there is only one that is still in the Dow today: General Electric (GE). All of the other Dow companies have been replaced or have gone bankrupt over the last 100 years or so. You may already know this. In the 20’s is often referred to as “the roaring 20’s,” partly because the market basically shot up for a 5-year period of time. It went up 300% from 1924 to 1929. Of course, we all know what happened in1929, something we hope to never see again: the biggest market drop in history, otherwise known as the Great Depression. After the great crash, the market lost a total of 89% of its value over the next 3-4 years. Imagine having $100,000 dropping all the way down to $11,000. One of the questions many people have is: “How long do you think it took the money to recover to 1929 levels?” It took almost 23 years for that money to recover. It wasn’t until 1952 that the people reached 1929 levels (forget about inflation, That’s for another time). The market, during this time, was in a 23-year bearish cycle before it actually broke even and took off again. Then, we had another bullish market. The bullish market lasted from 1952 all the way to 1966. What is unique about this 14-year period is that this is when the Dow Jones hit an index of 1000! The overall gain was approximately 150%. In 1966, it peaked over 1000, and then it came right back down, and never hit 1000 again and for another 14 years, when we had another bullish cycle of 1000% growth over 20 years until 2000. Everyone made lots of money. This is what we remember. Since 2000, we have been in a bearish cycle (12 years) with the DOW today still not caught up. The big question is: How much longer will this bear market last? No one knows for sure. Do you want to tie your retirement to the cycles of stock market when you can have guaranteed income for the rest of your life and not worry about the ups and downs of the market? You will be able to spend with confidence. 1974 was a very important year because some significant changes took place. The baby boomers made the market shoot up. The market’s great performance in the past is causing the market’s poor performance we are seeing today! Today, we’re in what we call a cyclical bearish market and we’re in year 12 of it. So, The Question On Everybody’s Mind Is, Where Do We Go From Here? Well, according to history, we could be in this bearish market for some time. I can’t say for certain—nobody can—but it is very much a possibility that we can be stuck in this cycle for some time. If that happens, as a retiree, you probably will not want to rely solely on the market to give you the income you want AND need in retirement. As we’ve seen, it “might” give you an extremely high return, or… well, it might do the extreme opposite. You Can Spend with Increased Confidence and Enjoy Your Retired Years More, Regardless of the Behavior of the Market if you plan for it correctly. There is never a time that any retiree should expose themselves to market risk until they have at least a portion of their monies in a guaranteed* financial vehicle that can provide them the secure and steady income they need to at least cover their basic living expenses. Once you do that, you can sleep at night and spend with confidence. I am absolutely opposed to putting the money you depend on for your basic living expenses in retirement in the market, because that money needs to be secured and protected, and THE MARKET WILL NOT DO THAT FOR YOU! The way you might be able to create greater financial certainty and a more confident, predictable retirement is to buy yourself an annuity that can act like a “personal pension” and provide you guaranteed* income in retirement that you can’t outlive no matter what the market decides to do today, tomorrow, or the next day. Cli’ck here to fill out the short survey or call us at (954) 781-2220. Statewide Retirement Planning Co. specializes in retirement income planning. We will spend as much time with you as you need to ensure that you know everything you need to know about products that might be suitable for your situation. Whatever decision is made is ultimately made by YOU. There is absolutely no obligation. We are here to educate you and help you live a happier retirement, because we believe when retirees receive a guaranteed* income stream that they can predict every single month for the rest of their lives, they become truly happier in retirement. There is no need to be concerned day in and day out about your money in retirement and one way to avoid that is by learning how to purchase your own “personal pension” Fill out this short survey here or call us at (954) 781-2220 to get started right away. *Annuity product guarantees rely on the financial strength and claims-paying ability of the issuing insurer. Call Statewide Retirement Planning Co. at (954) 781-2220 or Fill out the short survey HERE. That will put you in touch with a licensed advisor who specializes in retirement income planning. *Annuity guarantees rely on the financial strength and claims-paying ability of the issuing insurer. |

|

Devoted To Helping You Live A Happier And More Financially Secure Retirement **8 hour Workshop: New Conservative Investing Techniques In A Bear Market. Cl'ck here for details. ** Cli'ck Here to Get Your Free Copy of your "Guide To Social Security" and your income for life illustration. Go To SMARTMONEY Newsletter Archives Website: www.StatewideRetirementPlanning.com

Review our Highly Acclaimed Videos: Review our 10-minute video “Paycheck For Life” Statewide Retirement Planning Co. |

|